The tax authorities of our country (and not only ours) have been trying not for the first year to prove that it is not necessary to work with offshore companies. But business representatives continue to use them for their offshore investments. In this material, let’s talk about the reasons for this “love” and the current trends in the use of offshore companies.

Is it legitimate to use offshore structures?

Legislation of Ukraine does not prohibit the use of offshore companies. Of course, we are not talking about the situations where taxes are not paid at all (aggressive tax planning). The settlements with partners from offshore companies will undoubtedly cause questions from the tax service. But, we repeat, there is no ban on this kind of transaction.

Schemes of work with the use of offshore structures

Let’s pay attention to offshore schemes, which have proved to be the most widespread.

Let’s start with trading schemes.

The practical benefit of using this kind of schemes is in a variety of options for optimizing income tax, VAT and customs-related payments in the Ukrainian company. Also, on creating certain conditions, many organizations saved on VAT at the level of the company from Europe, and any investment in the business brought a stable income growth.

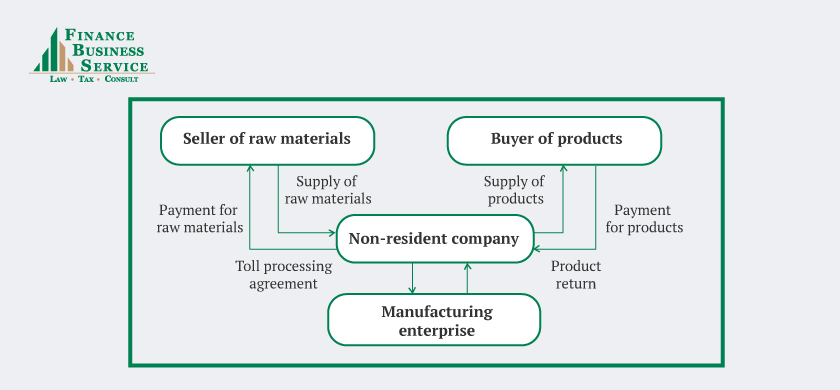

Toll processing scheme

The toll processing scheme has shown itself for similar purposes within Ukraine.

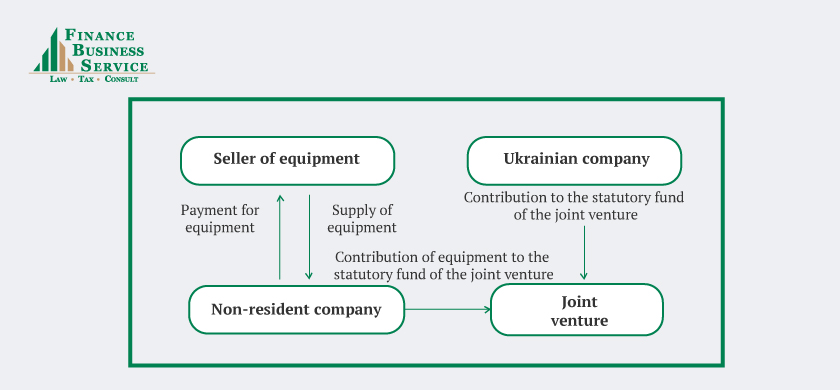

Savings on customs duties and VAT

Buying equipment for your own needs, business owners introduced a scheme for saving on customs duties and VAT.

Holding Schemes

The scheme in which a foreign enterprise functions as a holding company has become widespread. This option:

- helps to solve the task of reducing the tax burden when paying, for example, dividends;

- promotes confidentiality when registering assets in the territory of Ukraine;

- is used for the acquisition of patents and trademarks, as well as for the attraction of external financing.

Benefits of offshore

All successful cases for the use of offshore companies provide for the fact that the tax burden is shifted from jurisdiction with high taxes (for example, from Ukraine) to the jurisdiction where taxes are much lower.

Time for major changes

The above-mentioned opportunities for organizing business activities involving the companies from offshore jurisdictions, as well as their use by entire business groups and international corporations for aggressive tax planning, could not be ignored by the governments of developed countries. Of course, the tax fund must be filled, and they suffer significant losses of tax revenues to the budget.

In pursuing the goal of solving such a global problem, the OECD (Organization for Economic Cooperation and Development) has launched a number of serious initiatives. The most important among them is the BEPS (Base Erosion and Profit Shifting) Action Plan.

Since January 2017, Ukraine has become a member of the Enhanced Cooperation Program within the framework of the OECD, under which it committed itself to implement the Minimum standard of the BEPS Action Plan.

The Minimum standard includes the implementation of four mandatory measures:

- No. 5, countering harmful tax practices (combating tax abuses associated with the use of special harmful taxation regimes);

- No. 6, preventing tax treaty abuse (prevention of abuse when applying the double taxation conventions);

- No. 13, transfer pricing documentation and country-by-country reporting (improvement of the requirements of the current national legal norms to the transfer pricing documentation);

- No. 14, cross-border tax dispute resolution (efficiency improvement of dispute resolution mechanisms between the countries when applying double taxation treaties).

Taking into account the foregoing, the changes are systemic, and deoffshorization already has a serious impact on international business. Those business representatives who will change their business models, taking into account the innovations, will be able to stay afloat more. Those ones who focused exclusively on minimizing taxation would simply not be able to continue their normal activities.

When it is necessary to transfer money from offshore

In the light of the latest facts, the answer to this question for many owners of the companies that conduct international business will seem obvious: right now, because capital is under the threat! Naturally, many factors will influence your decisions in this context: further plans for the use of a particular company, its role in the business structure, domestic policy of the servicing bank (in some cases, quite tough with respect to offshore companies), etc.

Forms of withdrawal of investments

Having decided to withdraw investments from offshore, the owner faces such basic tasks:

- The withdrawal of assets (not money – real estate, sea vessels, etc.). In order to transfer the relevant assets, the Ukrainian owner must buy them, having made the deal properly.

- The withdrawal of funds. If funds are received by a legal entity, for example, for the provision of services, depending on the jurisdiction, it may be necessary to pay tax on income derived from foreign jurisdictions. The expenses associated with ordinary activities may be necessary to reduce the tax base.

A popular alternative is the withdrawal of money to a natural person. There is an option to transfer remuneration to his bank account, for example, to a member of the board of directors, funds under a gift agreement, for services, as dividends, etc. If a service contract is concluded and the transfer will be made by several transactions – be careful, such services can be recognized as entrepreneurial activities, with all the attendant consequences.

Note also that depending on the tax residence of the above-mentioned natural person, he may have obligations from the submission of a declaration of income to the tax authority and payment of the relevant amount of tax. When transferring money, you must be sure that you are acting within the framework of the currency legislation of the relevant country, and there will be no claims to the source of income. In any case, each individual situation requires careful analysis.

The situation with offshore jurisdictions is changing quite dynamically. Therefore, it is important for business owners to monitor constantly any innovations and changes in the jurisdictions of your interest. At the same time, it is advisable to take concrete steps to move to the organization of activities under more transparent rules and principles, perhaps, to consider the registration of a non-offshore company. The use of companies from respectable jurisdictions with the proper structuring of business allows to achieve significant tax savings.