Back in the first quarter of 2018, namely on February 19, 2018, a draft of advisory document was published on the official website of the Organization for Economic Cooperation and Development (OECD), which called on all interested parties to join the discussion on the OECD strategy for combating the loopholes on using the Common Reporting Standard (CRS, Single standard of tax information exchange) in the “citizenship by the investment” (CBI – granting citizenship in exchange for investments) and “residence by the investment” (RBI – granting a residence permit in exchange for investments). To date, more than 70 jurisdictions in the world offer these schemes.

On April 17, 2018, a 96-page document was published on the OECD website (PUBLIC INPUT RECEIVED ON MISUSE OF RESIDENCE BY INVESTMENT SCHEMES TO CIRCUMVENT THE COMMON REPORTING STANDARD), which, in fact, summarized the first results of the discussion and the contents of the official letters to the organization. More than 20 structures were the speakers, including:

- AFME office in London (Association of Financial Markets in Europe, it brings together the largest agents in the capital markets in the region);

- Italian consulting companies Pirola Pennuto Zei&Associati and Lexhack;

- non-governmental organizations (Transparency International);

- FBF (Federation Bancaire Francaise) from France, which integrates financial institutions and banks;

- Ministry of Finance of Dominica;

- associations of Caribbean low-tax jurisdictions (Grenada, Antigua and Barbuda);

- the world’s largest companies providing consulting and auditing services (BDO, KPMG);

- leading companies in the sphere of providing CBI and RBI services (CS Global Partners and Henley&Partners), etc.

During the discussion, the participants performed with counter-arguments and counter-proposals on contentious issues. Let’s try to understand and fix the most important points after the first round of the discussion.

First of all, it should be noted with regret that there is only one representative of the state in the list of participants of the discussion (the Ministry of Finance of Dominica), and only one representative of civilian non-governmental organizations (Transparency International) and no program leaders of CBI (Austria), RBI ( Greece, Spain, Latvia, Portugal) and European OECD countries are represented.

In the process of discussing the topic, the OECD has received a sufficiently large number of proposals. For example, the Panama branch of BDO (the global audit company, ranked the fifth after Big 4) has proposed to implement a new rule that will maintain the previous tax status for the buyer for another 2 years after the purchase of a residence permit or citizenship through investments without the possibility of changing tax jurisdiction. In addition, the subjects of tax declaration will be obliged to take an oath and, if it contains inaccurate information, strict sanctions will follow.

KPMG has made proposals in the same vein: between the new and old jurisdictions of the tax resident, it advises to organize the exchange (even mandatory) of personal information (taxpayer ID number [tax number] of the applicant and the date of his birth).

Transparency International, in the above processes, strongly recommends monitoring such sources as Interpol databases and conducting a thorough analysis of accounts in social networks.

In addition, the representatives of the legal department of KPMG insist on mutual transfer of financial statements (first of all, when the resident is mostly in the old jurisdiction and does not hurry to change his place of residence).

Time will show how the OECD will respond to such proposals and other participants in the discussion. But it can be noted now: following its reputation, KPMG maintains the maximum level of transparency and even rigidity in relation to investors. Most likely, that other companies from Big 4 will support this position. After all, these companies are inextricably linked to servicing the tax interests of the G-7 and G-20 countries (the main customers of the global tax administration strategy, which is being implemented through the OECD).

What is the cause for interest in the RBI and CBI programs?

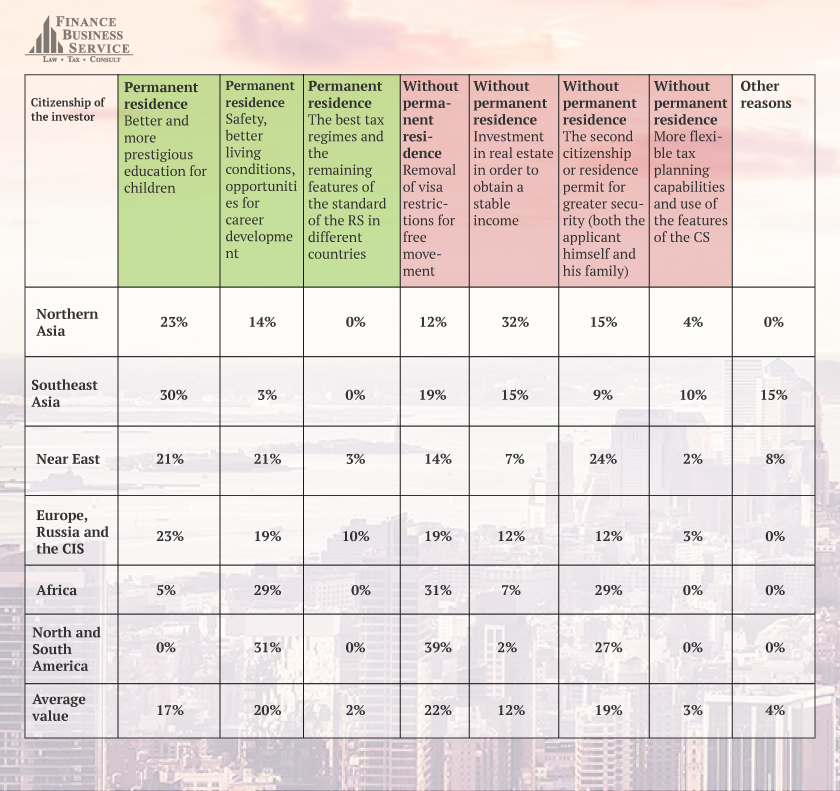

The OECD document of April 17, 2018 (hereinafter referred to as “the document”) is also noteworthy in that it contains the analysis results of Henley&Partners company regarding the main reasons for choosing RBI and CBI programs. The company conducted a survey of hundreds of its customers around the world, and grouped the results by category – the choice of permanent residence or without it.

Reasons for investing in the CBI and RBI programs *

*According to data of Henley&Partners

30% (absolute majority) of the clients-participants of the survey are citizens of Southeast Asian countries (most likely, they are Chinese, but Henley & Partners does not provide such detailed information). Among the main reasons for investing are:

- removal of visa restrictions for free movement (22%);

- security, better living conditions, opportunities for career development (20%);

- more qualitative and prestigious education for children (17%).

- Proceeding from the position stated in the document, it is possible to conclude that Henley & Partners:

- fully supports the measures to block possible loopholes, as well as the overall strategy of the OECD for improving the effectiveness of CRS;

- notes the imperfection of the Common Reporting Standard in the existing form and recommends taking measures to eliminate the shortcomings, including the legal non-identity of the status of the tax resident and basically citizenship. This moment is one of the conceptually important provisions of the OECD document.

The main difficulties and obvious problems of CRS: the results of the first round of open discussions

The first round of the global discussion process of the CRS has showed that there is still a lot to be done on the purity and transparency of the standard. Undoubtedly, it is pleasant that almost all participants in the discussion recorded a “presumption of innocence”. Therefore, they agreed that the programs of “citizenship by the investment” and “residence by the investment” are not an instrument of tax planning in order to evade the Common Reporting Standard. At the same time, the experts of OCCRP, Global Witness and Transparency International have the greatest concern about the existing corrupt climate in a number of countries, which can be an incentive for individuals to leave the CRS regime and play their game.

Summing up the results of the first round of discussions, the experts allocate the following difficulties and problems:

- Significant personal risks in the banking sector (insufficient responsibility of banks, it depends much on the specific manager working with the client on CBI and RBI).

- Insufficient control by governments (the features of local jurisdictions remain).

- Corruption risks (bad faith of certain officials).

- Unfair activities of various intermediaries – firms offering programs of “citizenship by the investment” and “residence by the investment”, and often misinforming the clients (for example, promising to provide “guaranteed” tax status when obtaining a residence permit or citizenship).

- Disadvantages of due diligence procedures. To be more specific, the current regulations make it possible to entrust the necessary procedures to a private person (and not only to licensed banks and independent organizations), which can incorrectly report the status of residence. At the moment, individuals can fill out a tax residency self-certification form approved by the OECD and pass a self-certification.

- The risks of information leaks, the protection of personal data.

So, what’s next?

Certainly, this list of disadvantages of the Common Reporting Standard can not be considered complete. And we can admit that expert consultations will continue for a long time. At the same time, there is a global structural imbalance between the world economy and politics.

The only objective chance to continue developing remains for a number of small countries – to attract investments, offering a residence or citizenship in exchange. And the OECD experts themselves agree that investors can be motivated to participate in the RBI and CBI programs for legitimate reasons, including the desire to remove the visa restrictions for free movement, as well as quite harmless desire to improve living conditions, career opportunities, etc. But it also claims that there is a possibility of abuse.

Obviously, in the future, the improvement of the CRS standard will increase the intensity of this kind of discussions. The G-7 and G-20 countries, as the main subjects of the world tax administration, are supposed to deal with complex challenges. In this vein, the Organization for Economic Cooperation and Development has a special responsibility to coordinate the interests and prevent a kind of “tax war” between rich countries and the rest of the world. It seems that the process of implementing the Common Reporting Standard in all groups of countries (including, as planned, in Ukraine in 2020) will be quite difficult and long-lasting.